Investors have responded favorably to the IPO of Diffusion Engineers Ltd. thus far, with bids for 24,42,32,032 shares against the 65,98,500 shares offered, resulting in a 37.01-times oversubscription.

On the last day of subscription, the grey market premium (GMP) for the initial public offering (IPO) of Diffusion Engineers Ltd is still high. Today is the last day of the IPO, which began on Thursday, September 26, 2024. Unlisted shares of Diffusion Engineers Ltd are selling at a premium of Rs 58, a 34.52 percent increase over the IPO’s upper price band of Rs 168, according to sources.

Diffusion Engineers Ltd IPO Subscription Details

Investor response to the IPO of Diffusion Engineers has been encouraging; bids have been placed for 24,42,32,032 shares compared to the 65,98,500 shares offered; by 10:27 AM on Monday, there had been a 37.01-fold oversubscription.

With 72.15 subscriptions, Non-Institutional Investors made the highest bid during the Diffusion Engineers IPO. According to NSE data, Qualified Institutional Buyers (QIBs) subscribed with 0.44, followed by Retail Individual Investors (RIIs) with 42.69.

Diffusion Engineers IPO Ltd Details

The IPO of Diffusion Engineers has a lot size of 88 shares with an issue price of Rs 159–168. As a result, buyers can bid in increments of 88 shares, the lowest quantity required for the Diffusion Engineers IPO. A retail investor can bid for one lot, or 88 shares, of the IPO for a minimum of Rs 14,784.

The allotment date of Diffusion Engineers Ltd IPO is October 1, 2024, and the listing date of IPO on the BSE and NSE is on Friday, October 4, 2024.

Diffusion Engineers plans to use the net funds from the initial public offering (IPO) for a variety of corporate purposes, such as financing capital expenditure needs and building a new production site.

Bigshare Services is the registrar for the public issuance of Diffusion Engineers, and Unistone Capital is the only book-running lead manager.

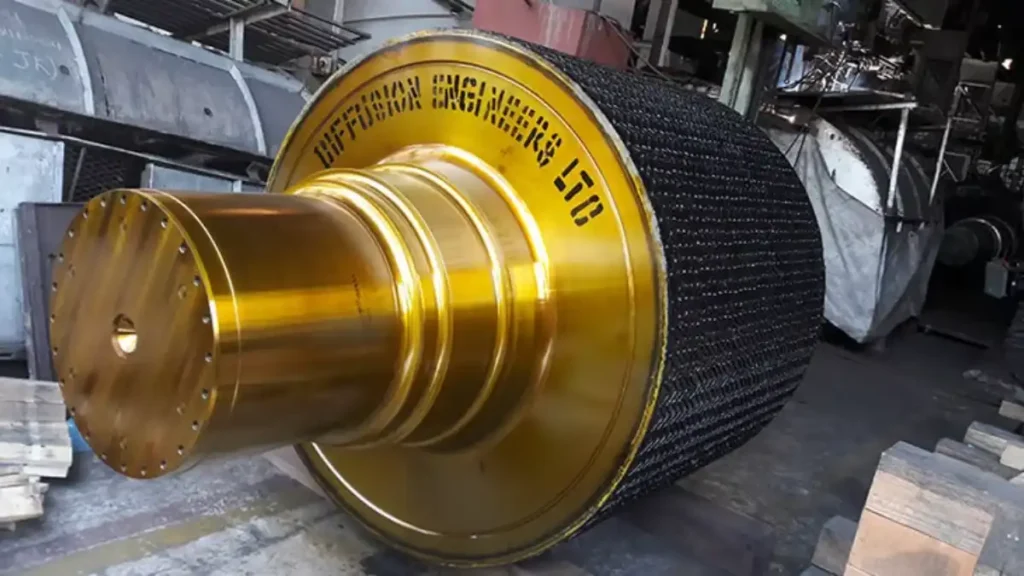

About Diffusion Engineers

Diffusion Engineers Ltd. is a company that offers technical solutions to clients in both domestic and foreign markets. The company has been in business for more than 40 years and offers a broad range of goods and services, such as the production of wear plates, heavy engineering equipment for core industries, and special welding consumables. It also offers heavy machinery and equipment repairs and reconditioning services.

Read more: Kalana Ispat SME IPO GMP Today and Other Details!