Hindenburg Research News: Published in January 2023, a critical analysis by Hindenburg Research aimed at Gautam Adani’s Adani Group. The report’s release had important ramifications since it caused the Adani Group’s stock value to drop dramatically.

On Saturday morning, US-based short seller Hindenburg Research company shared a message on Elon Musk’s owned X, implying that there might be more significant disclosures concerning Indian companies. The message said, “India, something big coming soon.”

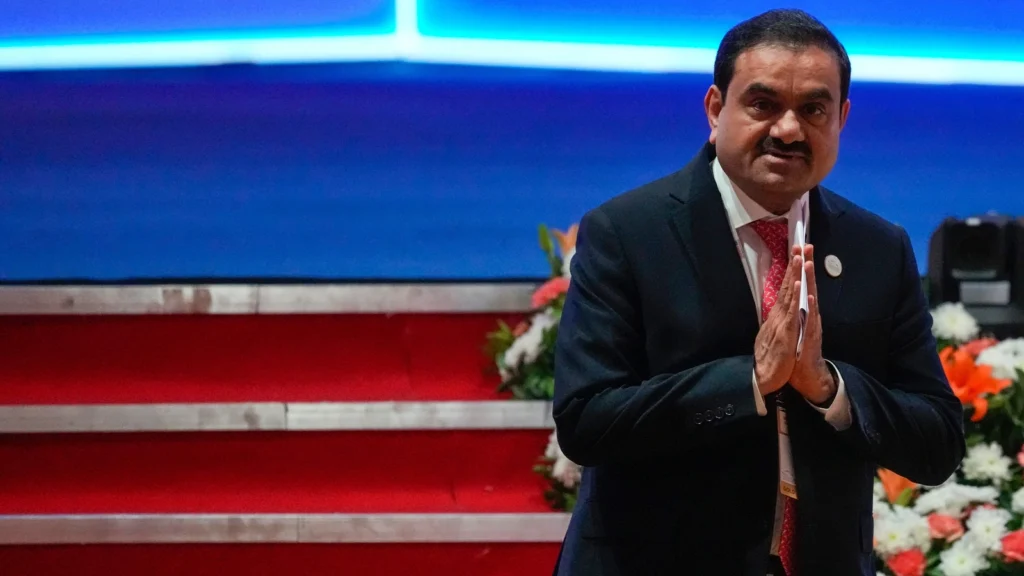

Hindenburg Report on Adani

Published in January 2023, a critical analysis report by Hindenburg Research aimed at Adani Group. The timing of the report’s release, which coincided with Adani Enterprises’ scheduled share sale, could not have been worse.

It led to an immediate $86 billion decline in the market value of Adani Group’s stock. The group then sold off a large amount of its overseas-listed bonds due to the steep drop in stock prices.

With the massive Adani scandal from the previous year, everyone is watching the US-based short seller closely for its next move.

When Hindenburg Research announced in June of this year that the Securities and Exchange Board of India (Sebi), the capital market regulator, had sent them a letter alleging violations of Indian regulations, the news grabbed attention.

Hindenburg Research Affair That Featured Kotak Bank’s Direct Mention

A watershed moment was the Hindenburg Research affair that featured Kotak Bank’s direct mention for the first time. As a result, Kotak Bank’s stock value saw a discernible decrease following this news, hitting its lowest point since June during the early trading session.

The notification from the Indian markets regulator dated June 27, 2024, according to Hindenburg, was “nonsense.” “It was concocted to serve a pre-ordained purpose: an attempt to silence and intimidate those who expose corruption and fraud perpetrated by the most powerful individuals in India”.

“While SEBI seemingly went to great lengths to assert its jurisdiction over us, our notice noticefully omitted the name of the party that actually has a connection to India: Kotak Bank, one of the country’s biggest banks and brokerage houses, established by Uday Kotak, who also designed and managed the offshore fund structure our investor partner used to wager against Adani,” stated Hindenburg. Rather, it just called the fund K-India Opportunities and covered up the ‘Kotak’ name with the abbreviation KMIL.”

It stated: “We suspect SEBI’s lack of mention of Kotak or any other Kotak board member may be meant to protect yet another powerful Indian businessman from the prospect of scrutiny, a role SEBI seems to embrace.”

What SEBI Said About Research

There were ties between Hindenburg Research and New York hedge fund manager Mark Kingdon, according to a notice from Sebi. According to SEBI, Kingdon received an early copy of Hindenburg’s report on the Adani Group around two months before its public release in January 2023, which allowed for large gains through clever trading.

Kingdon Capital had substantial holdings in Kotak Mahindra Investments Limited (KMIL), according to a notice from Sebi. It came to light that Kingdon Capital profited from the recent report-induced market turbulence.

Before the report’s release, the company took a calculated risk by investing $43 million to open short positions in Adani Enterprises Ltd (AEL). Kingdon Capital then liquidated these bets profitably, making $22.25 million in the process.

In addition, the Sebi letter included time-stamped transcripts of talks between traders connected to Kotak Mahindra Investments Limited and employees of the hedge fund. These trades are related to the trading of futures contracts associated with Adani Enterprises and suggest complex financial transactions between the parties.

In response to Sebi’s allegations, Kingdon Capital said that it was lawfully able to enter into these research agreements, which permitted the receipt and utilization of studies before their release to the public.

Nevertheless, Kotak Mahindra Bank denied knowing of Kingdon’s connection to Hindenburg or involvement in the use of private financial data.

Read more: Breaking Olympics 2024: Break Dancing Debuts at Paris Summer Olympics Games