On Wednesday, shares of IREDA closed at Rs 238.90, down roughly 0.65% for the day. The company’s overall market value was a little over Rs 64,000 crore.

The Indian Renewable Energy Development Agency Ltd. (IREDA) will be the subject of attention during Thursday’s trading session as the business considers raising capital. The PSU players’ corporate board will probably meet shortly to discuss and approve the fundraising plan.

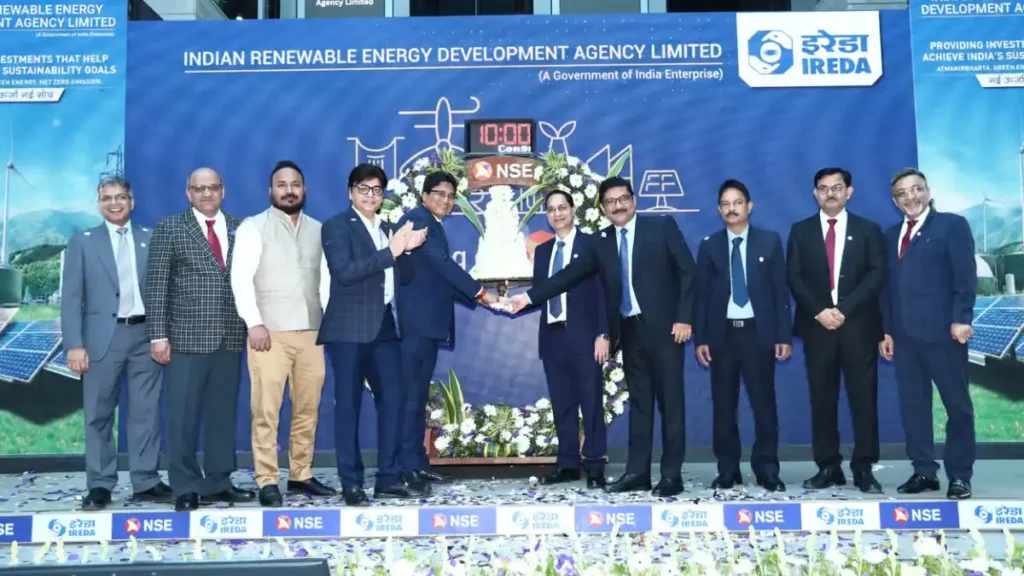

IREDA Fund Raise

The business stated in a stock exchange filing: “This is to inform you that the Board meeting of the Indian Renewable Energy Development Agency is scheduled to be held on Thursday, August 29, 2024, inter-alia, to consider and approve the proposal for raising funds by way of equity share capital for an amount aggregating of upto Rs 4,500 crore in one or more tranches”.

The fundraising may be carried out through any of the following authorized routes, subject to official or legislative approval: rights issue, preferential issue, qualified institutional placement (QIP), further public offer (FPO), or any combination of these, as may be deemed suitable.

On Wednesday, shares of IREDA closed at Rs 238.90, down roughly 0.65% for the day. The company’s overall market value was a little over Rs 64,000 crore. From its IPO price of Rs 32 and listing price of Rs 49.99, IREDA stock has increased by 650 percent and 380 percent, respectively. But from its 52-week high of Rs 310, it has plummeted by over 23%.

IREDA announced that for the April–June 2024 quarter, their net profit increased by 30% year over year to Rs 383.69 crore. During the quarter, operations brought in Rs 1.502 crore, a 32% YoY increase. Sequentially (QoQ), its asset quality also improved, with Gross Non-Performing Assets (NPAs) falling to 2.19 percent and Net Non-Performing Assets (NPAs) to 0.95 percent.

IREDA Share Price Target 2025

“Given the government’s focus on the renewable sector, we remain positive on long-term growth prospects which will aid long-term sustained growth in AUM,” stated ICICIDirect. With a “buy” recommendation on the stock, it continued, “Therefore, we value the stock at 49 times FY26E EPS, assigning a target of Rs 330.”

With its revised target price of Rs 130 and maintenance of its “sell” rating, Phillip Capital has maintained the business’s valuation at three times the FY26 ABVPS of Rs 42. “Passive flows, rather than any significant fundamental cause, are the driving force behind the stock’s recent increase. According to the statement released after Q1 earnings, “We believe the best is already priced into the stock.”

Read more: Orient Technologies IPO subscribed 6.64 times on Day 1, retail portion booked 10.5x